In this video, we walk through 5 REG practice questions demonstrating how to calculate tax depreciation for tangible business property using MACRS. These questions are from REG content area 3 on the AICPA CPA exam blueprints: Taxation of Property Transactions.

The best way to use this video is to pause each time we get to a new question in the video, and then make your own attempt at the question before watching us go through it.

Also be sure to watch one of our free webinars on the 6 “key ingredients” to an extremely effective & efficient CPA study process here…

How to Calculate Tax Depreciation for Tangible Business Property Using MACRS

MACRS is the current method of depreciation for most tangible business property, mandated by the IRS in the United States. It allows businesses to recover the cost of an asset over a specified life span through annual deductions (a.k.a. depreciation). Let’s dive into understanding how MACRS works, including the Section 179 deduction, conventions (half-year, mid-quarter, and mid-month), property classifications, and the distinction between personal and real property.

1. Overview of MACRS

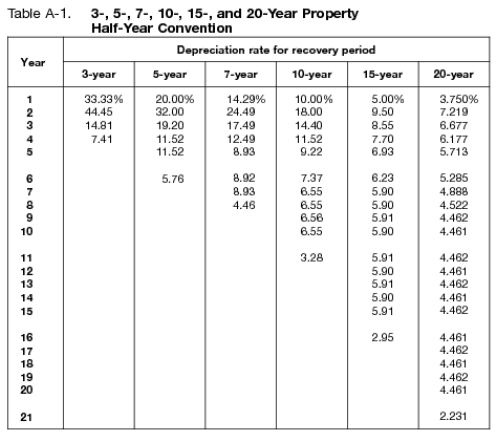

Under MACRS, depreciation deductions are calculated by applying a prescribed depreciation rate to the asset’s basis each year of its recovery period, depending on the category of the asset. The basis of the asset is generally its cost.

2. Section 179 Deduction

The Section 179 deduction allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year, but there is a maximum amount. This means a business can deduct the full cost of qualified assets from their gross income, up to that limit (for example, in 2023 the limit was $1,160,000). This deduction is intended to encourage businesses to buy equipment and invest in themselves. The Section 179 deduction is taken in the year the asset is placed in service.

3. Conventions

Conventions determine when and how much depreciation you can take in the year the asset is placed in service and the year it is disposed of.

- Half-Year Convention: Assumes all personal property is placed in service or disposed of at the midpoint of the tax year. This convention is used unless the mid-quarter convention applies.

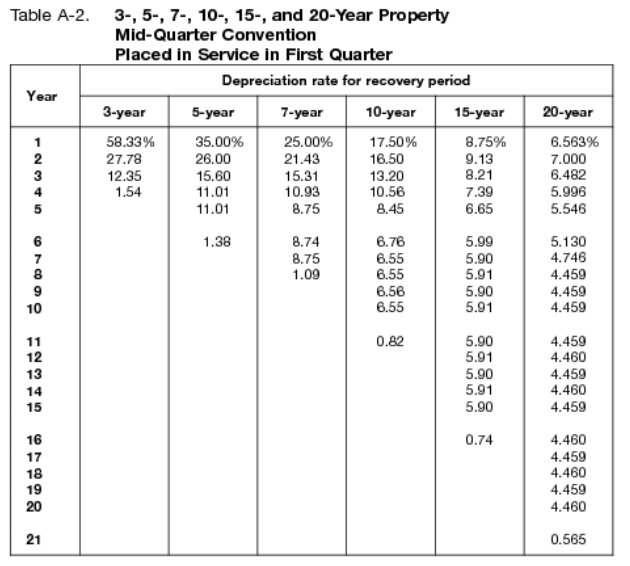

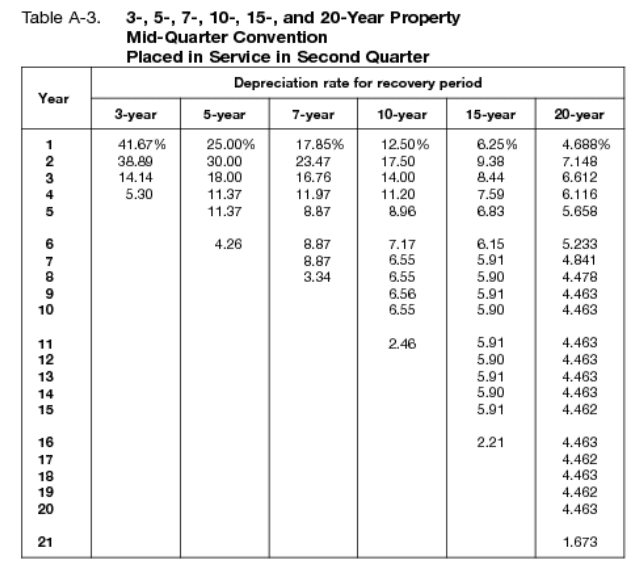

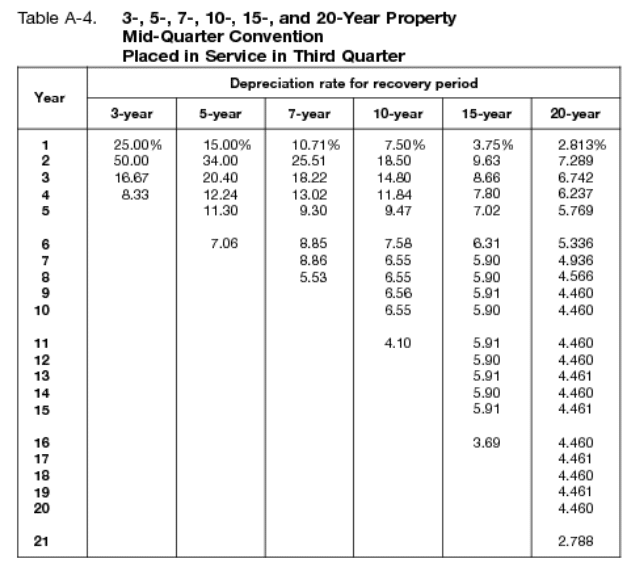

- Mid-Quarter Convention: Used if more than 40% of the total cost of personal property is placed in service in the last quarter of the tax year. It assumes personal property is placed in service at the midpoint of the quarter it is actually placed in service.

- Mid-Month Convention: Mainly applied to residential rental property and nonresidential real property, not to personal property. It assumes property is placed in service or disposed of in the midpoint of the month.

4. Personal vs. Real Property

- Personal Property: Generally, tangible, movable assets like machinery, equipment, vehicles, and furniture. Under MACRS, personal property can typically be depreciated over a 5-year or 7-year recovery period. There are other categories, such as 10-year or 15-year property, but these are uncommon and unlikely to be tested on the CPA exam.

- Real Property: Includes buildings and their structural components, generally depreciated over a longer recovery period of 27.5 years for residential rental property and 39 years for nonresidential real property.

5. Most Common Types of Property Under MACRS

- 5-Year Property: Includes computers, office machinery, cars, light trucks, and assets used in construction or research.

- 7-Year Property: Generally, office furniture and fixtures, and equipment.

- 27.5-Year Property: Residential rental property.

- 39-Year Property: Nonresidential real property.

Calculation Examples

To demonstrate how MACRS depreciation is calculated, let’s use a 7-year property example, such as office furniture, with a cost of $10,000, placed in service in July, making the half-year convention applicable since we aren’t told about any other purchases.

- Year 1: With the half-year convention, you apply a half-year’s worth of depreciation in the first year. Using the IRS-provided depreciation rates for 7-year property, the first-year depreciation rate is 14.29%. Therefore, the depreciation deduction is $10,000 x 14.29% = $1,429.

- Subsequent Years: You continue to apply the IRS-provided depreciation rates for each year of the asset’s recovery period (14.29% for the second year, 24.49% for the third year, etc.) to the asset’s basis.

- Section 179 Deduction: If you elect to take the Section 179 deduction, and the furniture qualifies, you could deduct the entire $10,000 in the year the furniture is placed in service, subject to the deduction limit and taxable income limitations.

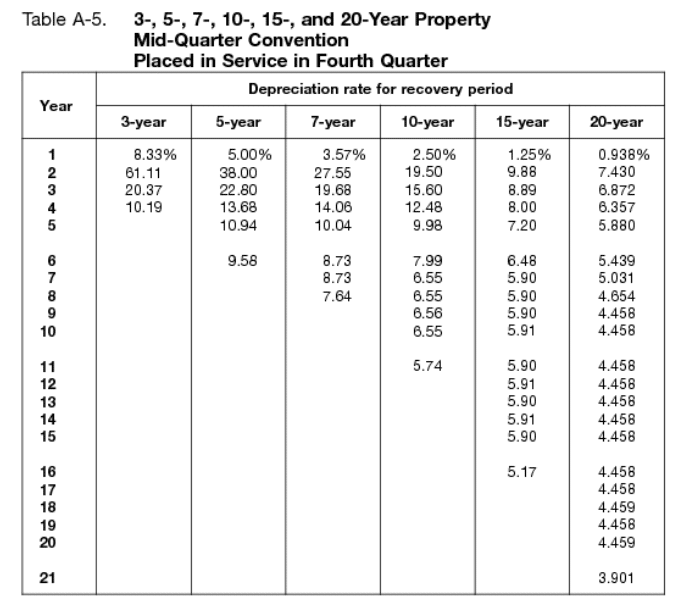

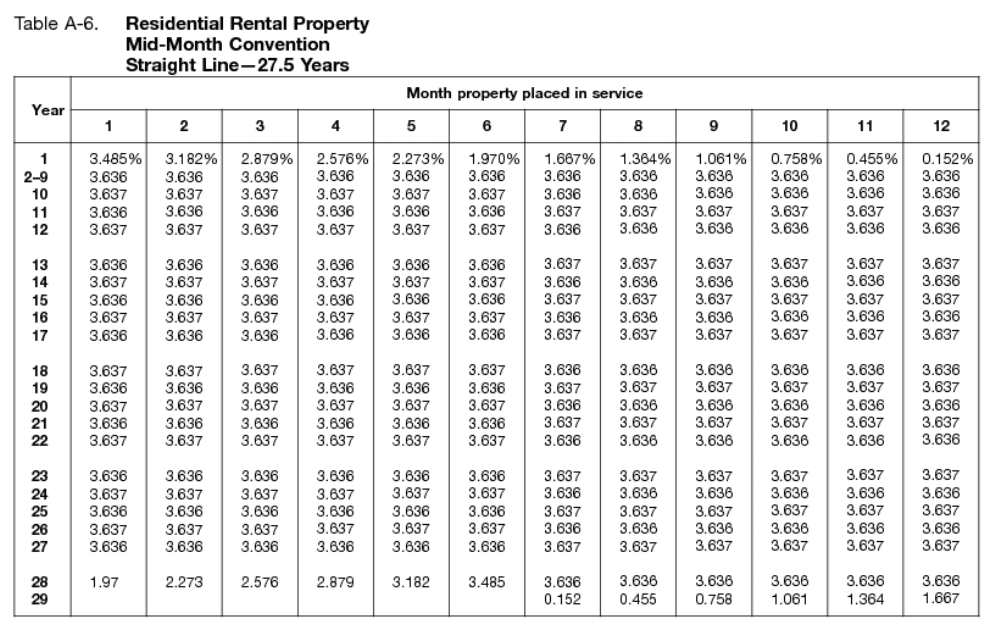

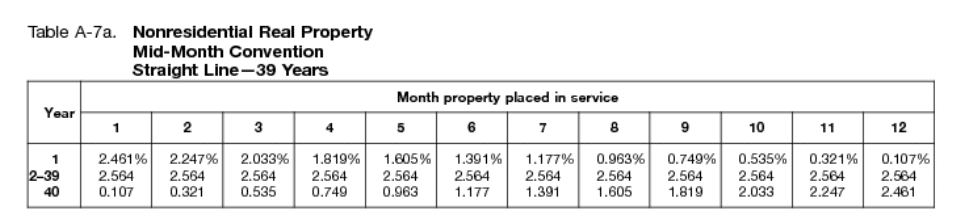

For your convenience, here are the most common table to use for MACRS depreciation, provided by the IRS. Here is the link to the IRS website for MACRS depreciation as well.